Risk Map

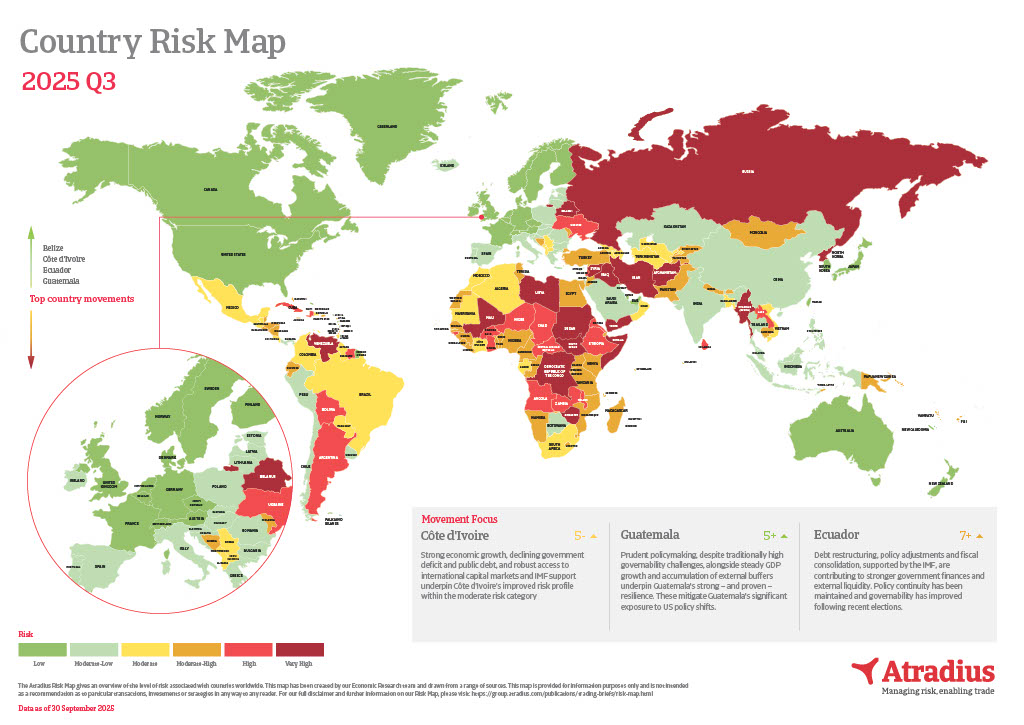

The Atradius Risk Map gives an overview of the level of risk associated with countries worldwide. It is based on data gathered by our Economic Research Team and focuses on a variety of factors.

United States

United States

The Atradius Risk Map gives an overview of the level of risk associated with countries worldwide. It is based on data gathered by our Economic Research Team and focuses on a variety of factors.

The Atradius Risk Map is drawn from a range of sources and features the STAR rating system. This is a system devised by the Atradius Economic Research Team for assessing country risk, including different political and economic trade risks, or civil unrest and conflict.

The Risk Map gives an overview of the level of risk associated with countries worldwide.

Companies that do business internationally rely on the stability of the business environment in the foreign country. Profits and investments can be vulnerable to adverse developments in this environment. These risks are broadly termed ‘country risk’. The level and change in country risk is, therefore, an important strategic and operational indicator for international companies.

Country risk covers a wide range of factors such as political developments, the risk of (armed) conflict and sovereign financial situation. These factors relate, for example, to regulatory changes, the risk of confiscation, civil unrest, war, currency controls and devaluations. Country risk takes into account a sovereign’s willingness and ability to pay and the impact of this on the ability of public or private entities to meet their cross-border payment obligations. Under our political risk cover contract, we provide cover against a subset of ‘country risk’ events. If you would like to learn more information about an individual market and their STAR rating, see our Country Reports.

Download Country Risk Rating Background

Côte d'Ivoire: Strong economic growth, declining government deficit and public debt, and robust access to international capital markets and IMF support underpin Côte d’Ivoire’s improved risk profile within the moderate risk category.

Guatemala: Prudent policymaking, despite traditionally high governability challenges, alongside steady GDP growth and accumulation of external buffers underpin Guatemala's strong – and proven – resilience. These mitigate Guatemala's significant exposure to US policy shifts.

Ecuador: Debt restructuring, policy adjustments and fiscal consolidation, supported by the IMF, are contributing to stronger government finances and external liquidity. Policy continuity has been maintained and governability has improved following recent elections.

Albania: Economic growth in Albania is strong, driven by high tourism sector income and strong domestic demand. Favorable economic conditions have led to improved public finances. The EU accession negotiations has started actively giving momentum for reforms.

Israel: High security risks, the rising public debt ratio and volatile domestic and regional political situation in Israel warranted a downgrade of one notch. It remains in moderate-low risk category though with a resilient economy and strong external finances.

Turkey: Turkey has been upgraded to 6+ thanks to improved external buffers, reduced financial dollarization and more consistent monetary policymaking. The rating remains at the higher bound of the moderate-high risk category due to ongoing liquidity pressures and market volatility.

El Salvador: El Salvador’s risk profile is slightly improving thanks to the regaining of market access and a much-awaited IMF program. The risk of sovereign default has eased but implementation risks remain high. Full dollarization and external assets of the corporate sector mitigate currency, transfer & convertibility risk.

Latvia: Latvia's economic situation has weakened in the past few years – in part due to the negative impact of the Russia-Ukraine war on the investor sentiment and public finances – and it has some regional disadvantages against its Baltic neighbors. Risks to political stability are high but the political consensus is pro-EU.

Mongolia: Mongolia's been upgraded due to an improving political situation and strong growth outlook, but country risk remains moderately high. Its poorly diversified economy leaves it vulnerable to external shocks and expansionary fiscal policies are likely to widen external and internal imbalances.

Greece: Greece is maintaining steady economic momentum on the back of rising consumption and investment, underpinned by the EU’s Recovery and Resilience Facility. Improving economic fundamentals and prudent fiscal policy has helped the country weather shocks from the pandemic and energy prices.

Ethiopia: Financial pressures in Ethiopia have eased as a new IMF program commenced over the summer. But the sovereign remains in default and the ongoing debt restructuring negotiations are slow-moving. Governance and development indicators are poor and political instability and security risks are high.

View the risk map for more information.

STAR is the Atradius in-house political risk rating. STAR stands for Sovereign Transfer and Arbitrary Risk and represents a rating system for assessing country risk. The STAR rating is a summary measure of political risk relevant to the Atradius trade credit insurance contract and explicitly targets the impact on public or private entities with cross-border payment obligations.

Broadly speaking, the default triggers under an Atradius Political Risk Policy are classed as either Sovereign Transfer or Arbitrary Risk.

The STAR rating runs on a scale from 1 to 10, where 1 represents the lowest risk and 10 the highest risk. The 10 rating steps are aggregated into five broad categories to allow their interpretation in terms of credit quality. Starting from the most benign part of the quality spectrum, these categories range from ‘Low Risk’ to ‘Very High Risk’.

Download STAR Rating Background Information

This map is provided for information purposes only and is not intended as a recommendation or advice as to particular transactions, investments or strategies in any way to any reader. Readers must make their own independent decisions, commercial or otherwise, regarding the information provided. While we have made every attempt to ensure that the information contained in this report has been obtained from reliable sources, Atradius is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is accurate to our best knowledge and belief at time of publication but it does not aim to predict future developments. All information in this report is provided ’as is’, with no guarantee of completeness, accuracy, timeliness or of the results obtained from its use, and without warranty of any kind, express or implied. In no event will Atradius, its related partnerships or corporations, or the partners, agents or employees thereof, be liable to you or anyone else for any decision made or action taken in reliance on the information in this report or for any consequential, special or similar damages, even if advised of the possibility of such damages.

Get a Free, No Obligation Quote

Contact us