Dutch chemicals output should decrease by about 4% in 2022 as the industry suffers from high energy prices and supply bottlenecks of raw materials. In 2023, we expect output contraction to lower to about 1% because supply issues of commodities will ease.

Competitors from overseas (particularly in the US) currently face comparatively lower energy costs. This makes it difficult for Dutch and European chemical producers to pass on their sharply increased energy bills to end-customers. The number of Dutch chemicals companies which have reduced or temporarily stopped production has increased, because being fully operational is no longer profitable. Many intermediate products supplied by the chemical industry go to the rubber, plastics and furniture industries. Therefore, production bottlenecks have an adverse effect on the manufacturing capabilities of those sectors.

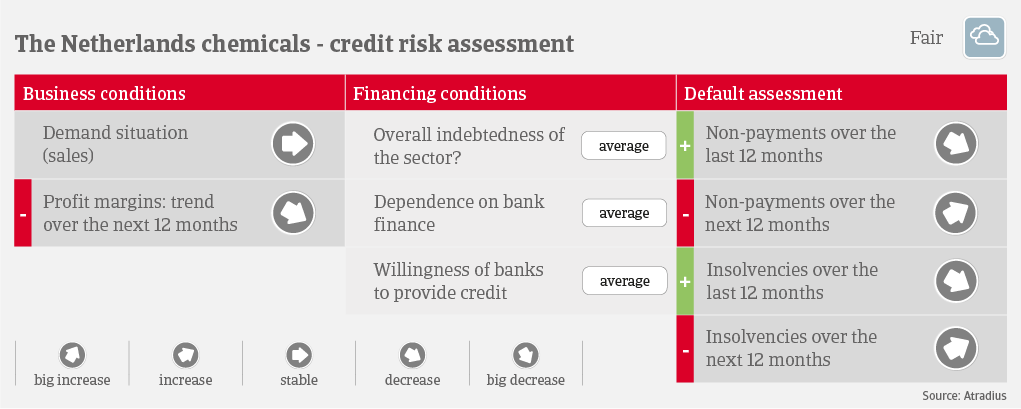

Profit margins increased in 2021 due to robust sales, but have started to decrease since Q2 of 2022 and will further deteriorate in the coming months. After very low numbers of payment delays and insolvencies seen in 2021 and in Q1-Q3 of 2022, there will be substantial increases in 2023. The main reason is the combination of high energy prices, lack of commodities, and fierce competition from abroad. Much will depend on the future development of gas prices, with the downside risk of gas rationing measures. Dutch small and medium-sized businesses whose energy costs amount to at least 7% of turnover can receive a compensation over the period 1 November 2022 up to and including December 2023 of a maximum of EUR 160,000 through the Energy Costs Allowance Scheme for Energy-intensive SMEs (TEK).

We expect the 2023 insolvency surge of chemicals businesses to be much lower than the 77% increase we expect for all Dutch businesses. Coming from a very low level, the increase will be a return to (normal) pre-Covid levels.

We currently assess the credit risk situation of the Dutch chemicals industry as “Fair”, given the strong financial position of many businesses, in particular multinational players. However, challenges are mounting. Should high gas prices in the Netherlands persist over a longer period, new investments in chemicals production sites could drift to markets where energy is less expensive. Additionally, higher investments in order to meet environmental standards will be a challenge, due to both tighter regulations and growing demand from consumers for ‘greener’ products.