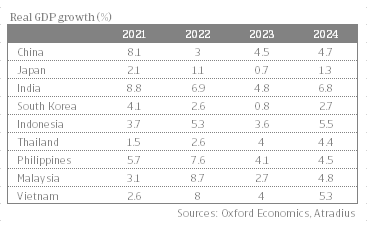

- The economic recovery in Asia is clearly losing momentum. China and Thailand are expected to show higher growth in 2023 than last year, but in the rest of the region growth is taking a step back, due to tight financial conditions and weak external demand. In the course of the year, however, the impact of these headwinds will decrease gradually. Next year growth will return to a decent level.

- The ASEAN-5 economies benefit from their increased resilience to external shocks. Due to developments in the last two decades that have strengthened their economies and financial systems, they are also more attractive for foreign investments. The latter applies to India as well, where the business climate has improved considerably in recent years. Thailand and South Korea, however, face some risks associated with high household debt.

- The Chinese economy is performing well in the short term, but is facing a structural growth slowdown. Its ageing population, a human capital mismatch, low productivity growth, supply chain changes and geopolitical rivalry are the main reasons why China is at risk of falling into the so-called middle-income trap.

- A growing risk for Asia in the medium to long term is increasing geo-economic fragmentation. Several Asian countries will benefit from related supply chain diversification, but far-reaching geo-economic fragmentation owing to geopolitical considerations has potentially large economic losses, especially for Asia.

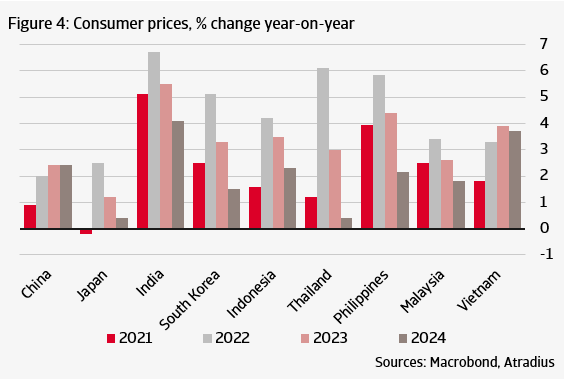

For several decades, Asia has generally been the region with the highest economic growth in the world. In line with this, most economies in the region have shown a solid recovery from the period of weak or even negative growth caused by the Covid-19 pandemic. As expected, the economic recovery continued into 2022, aided by vaccination campaigns and fiscal stimulus. However, unexpected headwinds emerged in the form of the Russian invasion of Ukraine and increased geopolitical tensions in the region. Inflation, already high, rose further and central banks were forced to adopt or maintain tight monetary policy. In addition, China continued to adhere to the strict zero-Covid policy for a long time, as a result of which the growth of this important economy lagged behind expectations.

The economic picture for the coming year is dominated by the negative effects of tighter financial conditions, a weak global economic environment and geopolitical tensions, counterbalanced by the stimulus coming from the reopening of the Chinese economy. Most economies appear to be well cushioned against the various headwinds because of increased resilience. At the same time, the downside risks to the growth prospects in the region, and globally, are high as geopolitical developments are difficult to predict – a lesson learned from last year.

Growth recovery loses steam

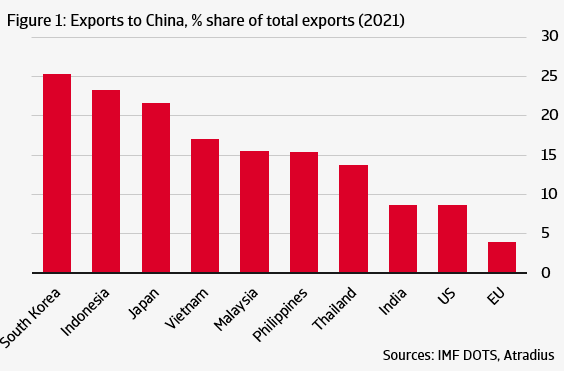

The growth recovery in the major Asian economies is currently taking a step back. In most countries GDP growth this year will be lower than in 2022, but next year growth will pick up again to a decent pace. One of the reasons for the expected acceleration in growth in 2024 is that the Chinese economy is rebounding after the authorities ended their strict zero-Covid policy. However, one should be wary of excessive optimism about the Chinese economy. At the start of the year it is unclear to what extent the end of the zero-Covid policy in China will lead to an upturn in the economy. Private consumption growth in China will pick up thanks to pent-up demand and excess savings, but weak consumer confidence may hold back spending for some time. Companies will be more inclined to invest as the domestic economy reopens, but weak external demand from developed economies and the weak real estate sector are also putting a brake on growth. China's economic development is of great importance to the region, as the country is the most important export destination for most countries and often also an important source of direct investment.

Besides the reopening of the economy, fiscal policy - labelled by the government as "proactive" and "pro-growth" - and accommodative monetary policy will support growth. Inflation will probably rise to 2.4% on average in both 2023 and 2024, from 2.0% last year. A further rise is unlikely, since softer international commodity prices will curb domestic price pressures.

Despite these incentives, and based on the aforementioned negative factors, the Chinese economy will probably not grow much faster than 4.5% this year. Last year, GDP growth came in at a meagre 3.0%. For 2024, we expect growth to be slightly higher than this year, with private consumption still the main driver of growth. Exports will then also grow faster again, but net foreign trade will make little or no contribution to GDP growth, due to an upturn in import growth. Meanwhile, the underlying growth profile for the Chinese economy is far from positive. Multiple adverse developments play a role in a structural growth slowdown that will not be easy for the authorities to change.

China's faltering growth engine

The Chinese economy has grown fast for decades, making it into the world’s factory. Since 2010, however, economic growth is on a downward trend. Real GDP growth will decline to below 4% within a decade, and to an average of about 2% in 2031-2050. This structural growth slowdown means that China is at risk of falling into the so-called middle-income trap. The main reasons for this relatively pessimistic view are:

1. Ageing at an early phase of development

The share of the working population in China’s total population is decreasing rapidly. China has to deal with ageing at a much earlier stage of economic development than has been the case for most other G20 countries.

2. Human capital mismatch

A large majority of China’s workers is low-skilled, while another part of the working population is overeducated. This mismatch makes it more difficult for China to find the workers that are suitable for the jobs of the future, in the advanced manufacturing industry.

3. Low productivity growth

After impressive growth in the 2000s, productivity is barely increasing. The share of young companies in the economy has fallen, while that of old, underperforming state-owned enterprises remains high. Counterproductive in that respect are the government's grip on high-tech companies, putting a brake on essential innovation, and its focus on self-reliance, that comes at the expense of economic efficiency.

4. Global supply chain changes

The Covid pandemic and geopolitical developments have prompted governments and companies worldwide to make essential supply chains less vulnerable. Decoupling, albeit only in high tech and some other sectors, will entail a declining exchange of technology and knowledge, and therefore will negatively affect China's growth potential.

5. Geopolitical rivalry

The US-China trade war, including US restrictions on the export of high-tech products to China, will put a brake on further development of the Chinese technology sector.

For more details, read China's faltering growth engine, Atradius Economic Research, January 2023

Japan and South Korea, like most other advanced economies worldwide, will still feel the adverse impact of high inflation on consumption growth and business investment in 2023. Price pressures will probably peak in the first quarter of the year, but with prices remaining elevated, the scope for domestic demand to recover is limited in the rest of the year. In Japan, pent-up demand will partly compensate for high prices, allowing the consumption recovery to continue, but at a lower rate than last year. Fixed investment will show a recovery after last year’s contraction, helped by increasing export production (particularly in the automotive sector) in the second half of the year. Exports will be somewhat hindered by a stronger yen, and will show hardly any growth. We expect the Japanese economy to grow by a modest 0.7% in 2023, with the situation strengthening over the course of the year. Next year, real GDP growth will accelerate to about 1.3%, mainly because of lower inflation and stronger external demand.

Although South Korea's export-to-GDP ratio is not as high as in some other Asian economies, exports are crucial to the performance of the economy. Weak growth worldwide and an ongoing downturn in the semiconductor cycle will therefore lead to a sharp contraction of exports in 2023, while thereafter the expected recovery in South Korea’s major export destinations will actually lead to a recovery in both exports and business investment. A recovery in tourism from China will also play a positive role later this year. For private consumption, the outlook is broadly in line with that for Japan, with weakness in the first half of the year due to relatively high inflation, and an improving picture in the second half and early 2024, when inflation subsides.

For the time being, however, the year has got off to a weak start, partly because the central bank, in response to the rise in inflation, has raised its policy rate by a cumulative 300 basis points this cycle, the steepest pace of hikes in its history. High interest rates are weighing heavily on households in South Korea because their collective debt, at 106% of GDP, is one of the highest in the world. In addition to monetary tightening, the authorities have implemented macro prudential measures to slow household credit growth, while there are plans to increase the housing supply to address supply-demand imbalances. The effects of these measures are already visible in falling household loans by depository corporations and declining house prices, but the situation will probably keep a lid on consumer spending for much longer. We expect the South Korean economy to grow 0.8% in 2023 and about 2.7% in 2024.

Stronger business climate supportive for India

Likewise in India, higher borrowing costs and softer demand for exports are dragging down economic activity. Household spending held up well last year, growing about 12% year-on-year, primarily supported by pent-up demand. However, as monetary policy transmission has begun to play out amid still elevated price pressures, consumers are turning more cautious. Private capital expenditure is also weaker than last year as higher interest rates and the slowdown in key export markets weigh on investment plans. However, the gradual easing of global commodity prices will bolster manufacturing performance in the course of the year and government spending is rising faster than last year. Increased revenue collection will enable the government to increase spending without compromising the budget deficit. The pace of fiscal consolidation is too slow to prevent a rise in the government debt ratios. Public debt is expected to rise to more than 60% of GDP this year, while the broader general government debt ratio is nearing 90% GDP. A rating downgrade is not likely, with the government expected to increase its efforts to consolidate its finances, and most of the debt financed domestically. For 2023 we expect real GDP growth of 4.8%, which is lower than last year’s 6.9% and the average of the pre-pandemic years. However, India remains one of the better performing Asian economies in 2023 and GDP growth likely will rise to 6.8% in 2024.

One reason for India’s relatively strong performance is that the surge in inflation has been less severe than elsewhere and the impact of weak external demand is likely to be fairly contained because exports account for a relatively small part of GDP. In addition to this cyclical advantage, a gradual but continued improvement of India’s business climate is helpful. Governance has been improving, with changes to labour laws and investment incentive schemes providing support for growth in the manufacturing sector. India still struggles with bureaucracy and other problems, but the jump the country made in the World Bank's Ease of Doing Business ranking is illustrative of this improvement. In the period 2015-2020, India rose from 134th place (out of 189 countries) to 63rd place, passing Vietnam, Indonesia and the Philippines, among others. Logically, an increasing number of international firms that look to diversify their supply chains are extending their manufacturing activities into India.

Growth slowdown in ASEAN-5 will not last long

With the exception of Thailand, the five largest economies in Southeast Asia will show lower growth this year, following a strong recovery in 2022. Here again, tight financial conditions and weak external demand are the main reasons. The latter factor weighs particularly heavily for Vietnam, Thailand and Malaysia, but less so for Indonesia. Growth of both private consumption and business investment will slow in Indonesia, but high levels of commodity exports will mitigate the growth slowdown. Later this year, private investment will benefit from the amended Omnibus Law, most of all in the construction and mining sectors. GDP growth is expected to slow to 3.6% in 2023 from 5.3% last year, before climbing to 5.5% in 2024.

Unlike many other countries in the region (and globally) Thailand will show an acceleration of GDP growth this year. Helped by the end of China's zero-Covid policy, the number of tourism arrivals is expected to rise in the course of this year. This is also positive for income growth, which is supported by a tight labour market as well. The economy, however, in recent years has been growing slower than the other ASEAN-5 economies, and will feel headwinds in 2023 as well. Last year’s high inflation rate has put a brake on real income growth, while weaker foreign demand is driving down goods export growth. Real GDP will probably rise to 4.0% this year and 4.4% in 2024, from 2.6% last year.

A lingering risk for Thailand’s economy is the high level of household debt, which rose to almost 90% of GDP during the pandemic period. For the coming years we foresee no problems, because the central bank will continue to refrain from raising interest rates aggressively, despite high inflation, and households will benefit from the economic recovery. In the long run, however, the high household debt might affect private consumption and derail the financial sector in the event of rising interest rates or falling income.

ASEAN-5 economies increased their resilience

The household debt problem in Thailand does not alter the fact that the ASEAN-5 economies are in a good position to weather economic challenges and pursue sustainable growth in the future. Their resilience stems from several developments that have taken place since the late 1990s, when a financial crisis swept through the region. First, most countries have become more diversified, moving away from relying too much on commodity exports. Second, governments have increased their revenues, reduced their external debt and stepped up efforts to maintain price stability. Third, infrastructure has improved because of large investments in roads, ports, airports and telecommunications. This has helped to improve connectivity and made their countries more attractive for foreign investors. Fourth, most countries have strengthened the financial system by implementing measures to increase the resilience of their banking sector, improve regulation and supervision, and promote financial inclusion. All together, these developments have increased the ASEAN-5 resilience to external shocks, such as global economic downturns, fluctuations in commodity prices or events like the Covid-19 pandemic. Moreover, it is one of the reasons why these countries, like India, are able to benefit from the process of supply chain diversification that has been initiated in recent years.

The Philippines will see a growth slowdown from last year’s strong performance, which will last a bit longer than in most Asian economies. High inflation, at 8% year-on-year in December 2022, alongside continued, significant monetary tightening will weigh on domestic economic activity in the coming quarters. A moderation in global fuel prices and a gradual adjustment of domestic demand to higher interest rates mean that inflation is probably close to its peak. Inflation will, however, remain above the central bank's target band of 2%-4% this year - a further headwind for households. Meanwhile, the prospects for external demand remain tepid, which bodes poorly for the export sector. GDP growth, which reached a strong 7.6% last year, will probably slow to 4.1% this year. This is still one of the highest growth rates in the region, but because the consumer-driven economy of the Philippines is quite sensitive to high inflation, private consumption will strengthen only late this year. The prospects for private investment are better, due to further removal of entry and ownership restrictions on foreign businesses and a resilient services sector. On balance we expect GDP growth of 4.5% for 2024, which is relatively low for the Philippines, but still close to average growth in the region.

Unlike in the Philippines, economic growth in Malaysia will weaken this year primarily due to declining external demand. The economy closed 2022 on a strong note, but a fall in exports at the end of 2022 is expected to have a weak follow-up in the first half of 2023. The reopening of the Chinese economy will not compensate for the weakness in other markets. It can also be expected that weak exports will feed through to domestic demand. Government projects and private investment in residential development will support the economy in 2023, but weak exports are likely to weigh on business investment. Weaker employment and wage developments will put the brakes on private consumption. The outlook for the second half of the year is better, since an anticipated recovery of incoming tourism will boost activity in the services sector, and ongoing infrastructure schemes will help to support investment spending. Also positive is that inflation in Malaysia has not risen to the same level as in several other countries in the region. As a result, the central bank has only raised official interest rates to a limited extent. Real GDP growth this year is expected to fall to 2.7%, the lowest growth rate after Japan and South Korea. For next year, we expect growth to pick up again to a healthy 4.8%.

Vietnam registered strong economic growth in 2022, with GDP growing at 8.0%, the fastest pace in 25 years. Currently, however, the country is experiencing a significant slowdown in growth. The export-oriented manufacturing sector has been hit by weak external demand, which is spilling over into the domestic sectors of the economy, including mass layoffs in the textile and other sectors. Inflation rose above the central bank's 4% target last year and is not expected to fall any time soon. Therefore, and because of downward pressure on the currency, the central bank has moved to a tighter monetary policy, which will have a downward effect on private consumption. In the course of the year, the economy is likely to grow stronger again, aided by a recovery in inbound tourism, a more supportive fiscal policy than last year and international firms relocating manufacturing operations to or sourcing from Vietnam. Nevertheless, growth this year and next will amount to no more than 4.0% and 5.3% respectively, growth figures that are low by Vietnamese standards.

Huge consequences of geo-economic fragmentation, especially for Asia

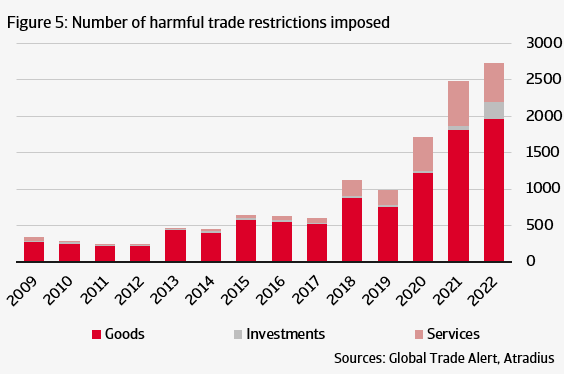

Supply chain diversification in Asia has been a hot topic in recent years due to various factors such as geopolitical tensions, natural disasters, and the Covid-19 pandemic. Many companies are exploring new ways to diversify their supply chains and reduce their reliance on a single source of production or distribution.

The Covid-19 pandemic currently seems to be almost over, but has raised awareness in both governments and internationally operating companies of the vulnerability of their global supply chains. The pandemic caused significant disruptions, leading many companies to re-evaluate their sourcing strategies. Some companies shifted their production to countries with lower infection rates, while others diversified their suppliers to reduce the risk of shortages.

Another important factor that has contributed to supply chain diversification, and probably will have a longer lasting impact, concerns the trade tensions between the US and China. Many companies have been exploring alternative manufacturing and sourcing locations to avoid the risk of tariffs and disruptions to their supply chains in the event of further escalation of the trade conflict. For several countries in Asia this has been beneficial, such as Vietnam, Thailand, Malaysia and India, which have been attracting more investment from companies seeking to diversify their supply chains. The shift of production from China to these countries comes on top of a process that started much earlier, caused by rising wages in China. The relocations, however, will be only gradual and limited to specific sectors, also because China will remain an important and growing sales market for consumer-oriented companies. Moreover, in addition to diversifying their suppliers and manufacturing locations, some companies are also exploring other ways to manage their supply chains, such as increasing the use of digital technologies and automation. Some companies are investing in technologies such as artificial intelligence and blockchain technology to improve supply chain visibility and transparency.

The supply chain diversification process, as far as it is driven by geopolitical tensions, can be seen as part of a potential decoupling of the Chinese and US economies or, if the process is broadening, a geo-economic fragmentation of financial and trade flows.

Several studies have concluded that the geopolitical rivalry between China and the US, and increasingly also frictions between China and other Western countries, are at the expense of the benefits of international cooperation, including free trade and exchange of knowledge. Regarding the latter, it is difficult to quantify exactly how big the disadvantages are, but an estimate by Oxford Economics indicates that if heightened tensions lead to technological decoupling, this will be more detrimental for China than for Western countries. China’s GDP growth would slow by almost 0.3%-pt. over the medium term, whereas the US and the EU would see growth falling by less than 0.1%-pt. An important reason for this difference is the impact of weaker knowledge transfers. While domestic Research and Development is hugely important, foreign knowledge spillovers contribute almost a third of the total knowledge contribution to productivity.

A recent analysis by the International Monetary Fund (IMF), presented in its Regional Economic Outlook for Asia and the Pacific 2022, highlights the potentially large economic losses for the world that could arise if these trends toward greater fragmentation continue. Based on longer-term model simulations from various sources, the IMF report concludes that a sharp fragmentation scenario, in which the world divides into separate trading blocs, would carry large, permanent output losses that are especially high for Asia, given its significant role in global manufacturing and trade.

There is as yet no question of a far-reaching decoupling of economies, if only because decades of globalisation and thus increasing connectivity between economies cannot easily, let alone quickly, be reversed. Early signs of trade fragmentation pressures, however, are clearly visible in data on trade-related uncertainty, which spiked in 2018 amid US-China trade tensions. From early 2022, the Russian invasion of Ukraine and related sanctions on Russia have increased the uncertainty around future trade relations.

The effect of this increasing uncertainty should also not be underestimated: it leads to less investment and a decrease in companies offering their products abroad. The consequences of this translate into lower economic growth and less employment, the opposite of the benefits of globalisation in recent decades. In the most extreme scenario, with elimination of trade in the energy and high-tech sectors between blocs and increased nontariff barriers in other sectors, annual permanent global losses could amount to 1.5% of GDP, and to 3.3% of GDP for Asia and Pacific countries.

Making supply chains less vulnerable to the possible consequences of a pandemic has a rational background in which risks are weighed against efficiency considerations. However, with regard to far-reaching geo-economic fragmentation due to geopolitical considerations, it is good to reflect on the potentially large economic losses.