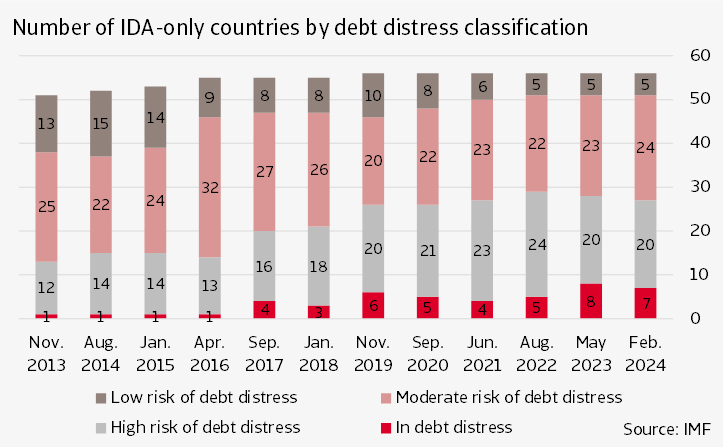

A series of adverse developments have increased the debt problems of vulnerable countries. The Covid-19 pandemic and the Russian invasion of Ukraine led to disrupted global supply chains, higher inflation and rising interest rates. These external shocks came on top of policy failures and other domestic problems, creating a perfect storm for many countries. In the past three years, the number of sovereign debt defaults in developing countries totalled 18, outstripping the total over the previous two decades. More may follow in the coming year as 20 countries eligible to borrow from the World Bank’s International Development Association (IDA) are at high risk of debt distress.

The problematic situation does not apply to all debtor countries. There is no general debt crisis as in previous periods since many countries are well positioned to cope with the challenging environment. Many low-income and several middle-income countries, however, are in a vulnerable position. Spurred by previously low interest rates, high investment needs and a lack of domestic revenues, debt in many poor countries has risen to worrying levels. According to the World Bank, IDA-eligible countries saw their total externally financed debt rising by 109% between 2012 and 2022, reaching a record USD 1.1 trillion. The increase was almost twice as fast as the 58% increase seen in middle-income countries. As a result, the debt-servicing costs on public and publicly guaranteed (PPG) debt for low-income countries are expected to rise by as much as 40% in 2023-2024, consuming a significant share of government revenues. The Fed is expected to start monetary easing later this year, which could provide some relief. However, the low interest rate environment as before the pandemic is not coming back. Moreover, because more than a third of that debt is financed at variable interest rates, the number of countries ending up in a debt crisis easily can increase further in the coming years.

1. Strong increase of countries with debt problems

If a country is in or close to an external debt crisis, it is now more difficult to find a solution than before. Negotiations about debt restructuring take more time and sometimes fail to even get started. It is the emergence of new creditors that plays an important role in this

New lenders take prominent role

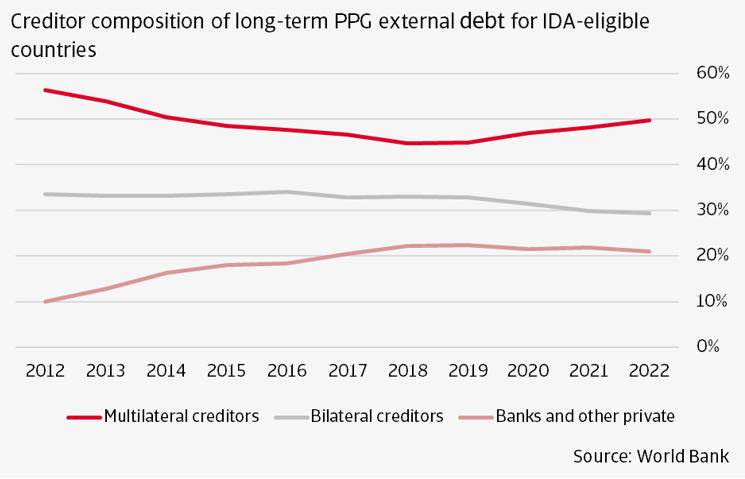

At first glance, the creditor composition of long-term public and PPG debt in the last 10 years has not changed much. In 2022, IDA-eligible countries borrowed 50% from multilateral institutions, 29% from bilateral official creditors and 21% from private lenders. In 2012, these creditor groups accounted for 56%, 33% and 10% respectively. Apart from the doubling of share of private creditors, the changes are limited. However, if we delve further into the data, two developments stand out.

2. No big changes of public debt creditor composition at first sight

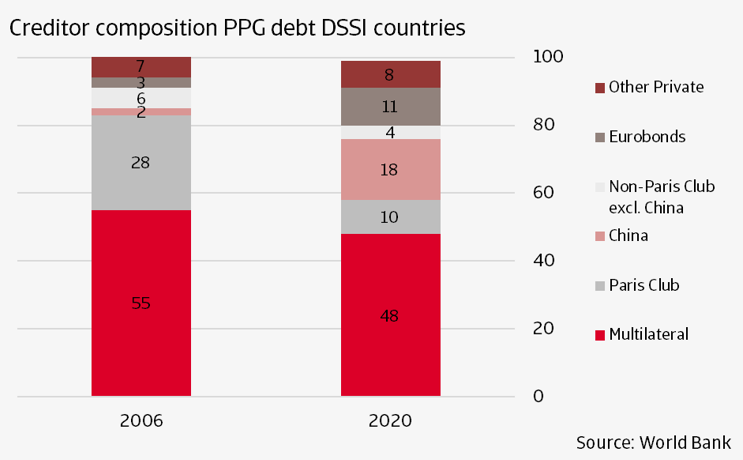

First, China's share within the group of bilateral creditors has risen sharply. In 2006, Chinese official creditors provided just 2% of PPG debt, but by 2020 this had risen to 18%. The increased share of China came at the expense of lending by Paris Club countries, which fell from 28% to 10% of total loans granted to public borrowers over the same period. During the Covid-19 pandemic, new debt commitments to low- and middle-income economies from China decreased – in line with lower total new commitments to these countries, as we describe below. However, this does not change the fact that developing countries currently borrow more from China than from the group of 22 Paris Club countries.

3. China has overtaken the Paris Club countries when it comes to lending to DSSI countries

Second, IDA-eligible countries have increasingly issued bonds, driving the doubling of the share of private creditors in long-term public and PPG debt. The share of Eurobonds increased from 3.8% in 2012 to 13.5% in 2022, after having peaked at 13.9% in 2021. Before the pandemic, IDA-eligible countries benefitted from the favourable global monetary conditions. Due to the low interest rates, many countries issued bonds for the first time or issued multiple times (Ghana, Zambia). Compared to domestic interest rates, the rates on Eurobonds were lower. Due to the underdeveloped domestic markets, domestic interest rates were high, resulting in high interest payments. Countries, like Ghana, replaced expensive domestic government paper by international bonds to reduce the interest burden on the budget. While these lower interest rates were attractive, the shift to international bonds also made these countries more vulnerable to changes in market sentiment, increasing the refinancing and exchange rate risk. This change of market sentiment happened when the pandemic came around and subsequently the war in Ukraine. Most developing countries lost their access to the international capital market and were faced with a sharp increase in borrowing costs. In Sub-Saharan Africa, where bond issues rose sharply until 2018, countries lost market access in 2020. It was only in January 2024 that an African country (Côte d’Ivoire) issued a Eurobond again.

It should also be noted that total long-term debt flows to low- and middle-income countries declined sharply in 2021 and 2022. In fact, new commitments to public borrowers reached their lowest level since 2011. The main driver was a fall in commitments from private creditors, with the decline from bondholders being the largest. Bond issuance by public and private sector borrowers fell sharply in 2022 due to the rising global interest rates, credit rating downgrades for several borrower countries and overall increasing risk aversion.

While bilateral and private creditors were cautious with their lending activities during the uncertain global economic environment of the last few years, the multilateral institutional creditors stepped forward as lenders of last resort. The World Bank and other multilateral development banks provided a record USD 115 billion in new financing in 2022, making them the primary source of new financing for developing countries that year. This seems to bring back old times, when multilateral institutions played a central role in solving or at least mitigating the debt problems of vulnerable countries. However, multilateral institutions no longer have the decisiveness they used to have because a large part of the debt involved in restructurings is in the hands of the new creditors.

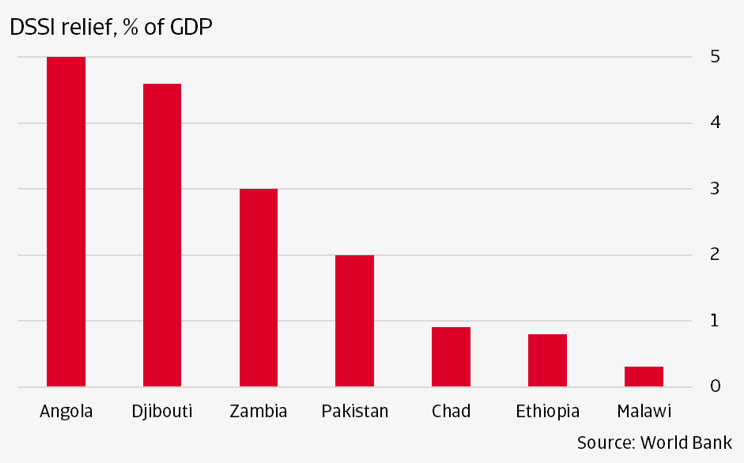

DSSI: temporary relief

During the Covid-19 pandemic, the G20 provided a temporary debt relief to low-income countries through the suspension of debt-service payments to official creditors. This initiative, the Debt Service Suspension Initiative (DSSI), ran from April 2020 until the end of 2021. It provided participating countries with some breathing room to increase spending on health and support for the most vulnerable households. It was in fact required that participating countries used these freed resources to soften the impact of Covid-19 pandemic. Countries were also obliged to work closely with the IMF and the World Bank, which were monitoring these countries.

The DSSI comprised of a suspension of interest and principal payments to official bilateral creditors. Although private creditors were asked to participate on comparable terms, only one did. But most DSSI borrowers were also hesitant to request forbearance of private creditors. Many feared the potential consequences for their sovereign credit ratings and future market access.

All IDA countries and least developed countries (LDCs) as defined by the United Nations that had no arrears to the IMF and the World Bank were eligible for the DSSI. Of the 73 eligible countries, 48 have participated and requested support from official bilateral creditors. Most of them came from Africa. According to the IMF, an estimated total of USD 8.9 billion in debt-service payment was suspended from May 2020 to December 2021. Less than the USD 12.9 billion initially projected.

Not all eligible countries were eager to participate in the DSSI. For some, like Nigeria and Honduras, the DSSI relief was rather limited due to the low level of official bilateral debt. Others, like Ghana and Benin, did not participate because of fear of negative consequences for their sovereign external ratings as applying to the DSSI could signal a deteriorating creditworthiness. However, rating downgrades due to participating in the DSSI did not happen. Some were placed on negative watch by credit rating agencies, but overall DSSI participation did not trigger severe adverse markets reactions. On the contrary, sovereign bond spreads even decreased for some countries.

4. Despite DSSI relief, debt issues arose for some countries

Although the DSSI did support countries, it was only a temporary liquidity solution as it provided a suspension of debt-service payments. Debt suspension received in 2020 was rescheduled with a one-year grace period and four-year repayment period. Debt suspension provided in 2021 was also rescheduled to a one-year grace period, but five-year repayment period. All countries are already repaying the DSSI relief. This creates an extra burden on governments that already have excessive debt-service payments in the coming years due to their elevated debt levels. Especially when these suspension of debt payments were relatively high.

As said, the DSSI only solved the liquidity issues and did not address the emerging solvency problems in countries. Of the DSSI participating countries, several have total public debt levels above 100% GDP and have a large share external debt. For many, debt repayments could become challenging because of these elevated public debt levels and the related high debt-service repayments – especially taking into account the high interest rates globally and domestically. The rising borrowing costs and the lack of access to international capital markets have raised the refinancing risk and default risk for many indebted countries.

Common Framework: patience needed

To address the more structural debt issues or the protracted liquidity issues, the IMF and the G20, together with the Paris Club, introduced the Common Framework (CF) in November 2020. The CF goes beyond the DSSI, but some argue not far enough. Debtor countries can request a debt treatment of all G20 official creditors under the CF. These creditors include the more traditional members of the Paris Club, but also new creditors like China and India. Next to this, the CF requires a comparable treatment from private creditors to ensure a fair burden sharing. A CF debt treatment is accompanied by an IMF programme.

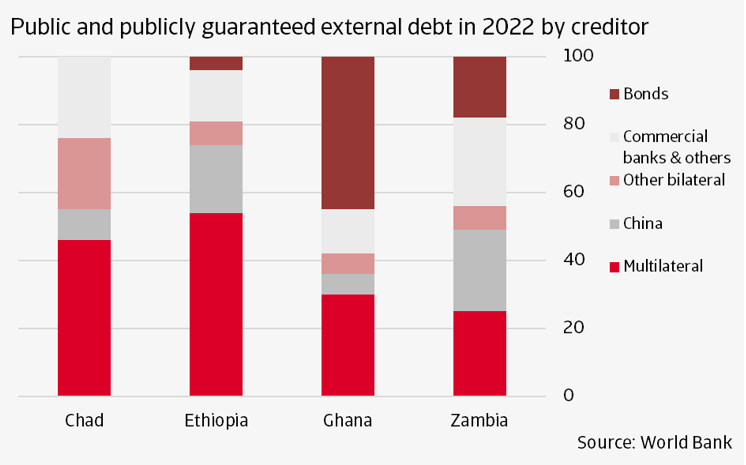

Only four countries have requested debt relief under the CF so far: Chad, Ethiopia, Ghana and Zambia. Progress is very slow with the only country successfully negotiating a debt restructuring being Chad. Although each of these four countries has its own challenges, the complex debt structure is something they have in common. The changed creditor base is clearly visible in these countries. Commercial debt to banks (Chad, Zambia) and Eurobonds (Ghana, Zambia) have become increasingly important. There is also the increasing role of new creditors like China (Zambia, Ethiopia). On top of the complex debt structure, domestic issues are also slowing progress (Ethiopia, Zambia). Ethiopia originally requested debt relief in early 2021, but due to the civil war, this process delayed. After reaching a bilateral debt-service suspension with China in September 2023, Ethiopia agreed with its official bilateral creditors a suspension of debt payments until 2025 in November 2023. This debt relief from the Paris Club is contingent on Ethiopia securing an IMF loan by March 2024, which is yet to be agreed on. Ethiopia missed an interest payment on its international bond at the end of 2023 and formally entered a default situation.

5. Varying debt composition countries under Common Framework

Chad, the first country to reach an agreement under the CF, had to restructure a commercial collateralised debt held by many banks and funds. A large private creditor agreed to reprofile part of the debt service due in 2024 and official creditors will contribute if this is not sufficient. For Ghana, a domestic debt restructuring was added to the requirements under the CF as it was deemed too large of a burden. Ghana defaulted on its Eurobonds in December 2022 and applied to the CF in April 2023, after it completed restructuring its domestic debt. A principle agreement with their official creditors was reached in January 2024. Still, the country needs to start negotiations with the bondholders, which could take quite some time.

Zambia is a case-in-point of how difficult the process of restructuring is under the CF. After defaulting on its Eurobonds in November 2020, Zambia requested debt relief under the CF in January 2021. After three years of negotiations, it looked like an agreement was finally reached. At least, until the official creditor committee rejected the restructuring deal the Zambian government reached with a number of private Eurobond holders because of breaching the comparability of treatment principle. Eventually, a revised deal was agreed between Zambia and its bondholders which was approved by China and other official creditors. It looks like there is finally light at the end of the tunnel for Zambia. But still, it needs to agree terms with other commercial creditors like Chinese banks.

When applying to the CF, both debtor and creditor countries need patience. With Chad being the only country to reach a debt deal so far and Zambia’s negotiations taking three years, the G20 Common Framework does not appear to be working properly. Due to the protracted nature and complexity of the process, other highly indebted countries could become increasingly reluctant to participate in the CF.

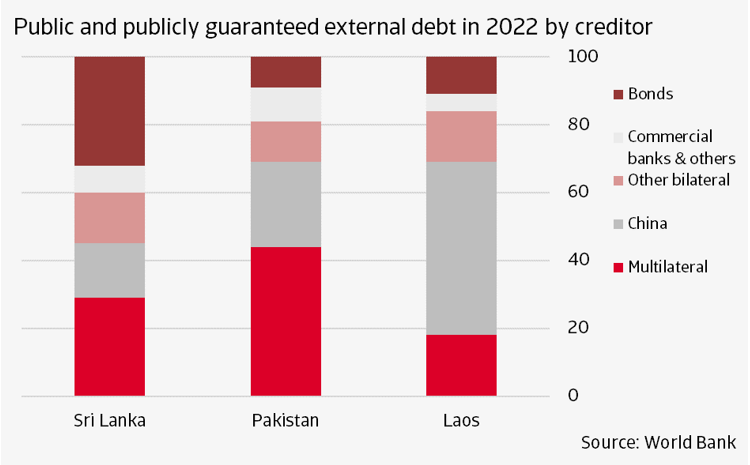

Some countries that could participate in the CF do indeed pursue bilateral negotiations instead, as we have seen recently with Malawi, Djibouti and Laos. Malawi is negotiating with commercial and official creditors outside the CF. Djibouti suspended debt payments to its major creditor China in December 2022 and is currently negotiating with its creditors, following the path of Angola. In 2020, Angola restructured part of its Chinese external debt when it faced debt issues. It seems that for countries with one creditor, in most cases China, a bilateral restructuring might be more efficient than one with all creditors under the same conditions. More efficient does not always mean that it is more favourable for the borrowing country. Laos, for example, will probably reach an agreement with China on payment deferments to support fending off a default later this year. However, as happened before, China’s support will be in exchange for access to strategic assets and resources, such as minerals and hydropower plants, and broader trade and investment opportunities.

HIGH DOMESTIC DEBT IS A COMPLICATING FACTOR

Sri Lanka: ongoing debt negotiations

Difficult negotiations on external debt are also taking place for countries that got into trouble due to financial mismanagement and political instability. Here too, the composition of the debt by creditor plays an important role. A notorious case is Sri Lanka which, despite being a middle-income economy, defaulted on its debt in April 2022. External shocks such as the Covid-19 pandemic and terrorist attacks contributed to a sharp rise of public debt. But long-term mismanagement of public finances is playing a much more significant role than these coincidental developments. Since the end of the civil war in 2009, the government chose to finance a series of major infrastructure projects with the help of Chinese loans, while at the same time rejecting grants and projects from other countries. Moreover, in addition to bilateral financing for investments in ports, energy, and transport, the Sri Lankan government also binged on international sovereign bonds, issued at relatively high coupon rates. When Sri Lanka defaulted, about one third of its foreign debt was in the hands of bondholders, while China, Japan, the ADB and the World Bank each held 9% to 13%.

Over the course of 2023, some light began to appear at the end of the tunnel. Sri Lanka reached a preliminary approval for debt restructuring from its bilateral creditors and secured board-level agreement to access the IMF's Extended Fund Facility (EFF) of USD 2.8 billion. In addition, the economy is performing better again this year, after two consecutive years of contraction. Sri Lanka, however, is not out of the woods yet. Adverse consequences of the financial crisis such as tight monetary and fiscal policies are holding back private consumption and business investment. Moreover, uncertainty about the debt situation will continue as the actual debt restructuring process is likely to last until the end of the year. Negotiations are difficult because a broad array of creditors is involved, including China, India, Iran, Kuwait, Saudi Arabia and Pakistan. As a result, Sri Lanka is expected to remain in default the remainder of the year, with external debt service suspended. Meanwhile, the upcoming presidential and parliamentary elections in October mean that political instability will persist in a period that the government must implement unpopular IMF-backed austerity policies. As a result, little needs to happen before social unrest will force the current government to postpone or delay the implementation of the much-needed IMF reforms.

6. Laos mainly borrows from China, while Sri Lanka owes relatively more to bondholders

Pakistan: recurring refinancing issues

Another middle-income economy coping with an external debt problem is Pakistan. The country has not defaulted, and probably will not in the near-term future. However, negotiations about debt restructuring will probably be needed because Pakistan’s export earnings are too low to meet future debt obligations. Here too, the government invested heavily in infrastructure projects, with China playing a major role in providing loans that pushed up the public debt level. Currently, the situation has somewhat stabilised, with the IMF and Pakistani authorities having reached a staff-level agreement on the final review of a nine-month Stand-By Arrangement (SBA). An important positive consequence of the IMF support is that it has encouraged other creditors to lend financial assistance to Pakistan. China, Saudi Arabia and the UAE, along with the World Bank and the Asian Development Bank were willing to provide Pakistan with loans which have averted a default for the time being.

For Pakistan the outlook is therefore probably better than for Sri Lanka, but here too the mix of further debt negotiations and an unstable political situation is an important risk factor. The SBA has been concluded positively mainly because the government last year implemented IMF-backed policy reforms such as a substantial increase in electricity and gas tariffs and tight monetary policy to combat high inflation. Further measures are necessary to get IMF support in the form of an EFF to maintain external solvency. However, it is uncertain whether this will work. In February 2024, a coalition government took office after controversial elections. The government can rely on the military for political support, but it has only a slim majority in parliament and is unpopular among broad sections of the population. Political stability will remain tenuous, especially if austerity measures further feed discontent among the population. If the coalition does not survive or if the government is unable to keep the IMF on board, a renewed financial crisis is in the cards again. Apart from that, support from other creditors is uncertain as well. Negotiations to reschedule part of the foreign debt will have to start in short term and China is likely to be a key part of that effort.

Private creditors are no easy negotiating partners

When bondholders are part of a debt restructuring it is becoming even more complex, not only one holder has a say, but several need to agree on the terms. Already this can take quite some time, but in the debt restructuring seen under the G20 Common Framework an important shortcoming is that any bondholder proposal negotiated with the debtor government remains subject to approval of official creditors. We saw this happening with Zambia’s debt restructuring when an initial deal with bondholders wasn’t approved by China, the largest creditor, because it appeared to favour private creditors. Currently, official creditors are first in determining how much debt restructuring is needed and private creditors need to follow on comparable terms.

Because the share of bondholders in defaulted debt is so large nowadays, there should be early and simultaneous engagement by debtor countries with all creditors. This could enhance prompt and effective debt solution.

China versus the Paris Club

The above shows that the emergence of new creditors has made debt restructuring negotiations more difficult than in the past. This is mainly due to China’s increasing role and its different approach to lending and debt relief. A comprehensive study that makes use of various sources says this approach concerns three aspects. The first one is that China puts more emphasis on creditor protection against default than other countries. For example, China requires borrowers to set up a special account to settle the borrower's debt obligations, which enhances the seniority of Chinese lenders' claims and shifts the burden of providing debt relief onto other creditors. Moreover, when debtor countries have run into problems, China shows little willingness to implement any haircuts. A second requirement is that borrowers must keep the terms of loan contracts and debt restructuring confidential. And finally, China is preferring bilateral solutions for debt problems instead of joining a multilateral approach.

This last point seems to be the fundamental reason for the difficult negotiations. China does not participate in the Paris Club, which facilitates coordination among public bilateral creditors, while this body is part of the previously common regime in which the IMF used to play the central role. China is the third largest shareholder within the IMF, but the country’s absence from the Paris Club is making it difficult for the IMF to respond rapidly to borrowers in distress. China’s differences with both the IMF and the Paris Club countries over debt transparency and burden sharing in restructuring increases the time needed to negotiate a programme with the IMF for those countries that have borrowed from China. Practice shows that the uncertainty associated with long negotiations translates to additional costs for the borrower. As long as there is no agreement, access to capital markets is not available and doors to other creditors mostly remain closed.

No solution in sight yet

Countries that have experienced, or have come close to, debt default in recent years are faced with complex coordination between a range of different creditors. In many cases, China and bondholders are prominently at the table, in addition to traditional creditors, and come with their specific interests and own approach. The G20 Common Framework, where all creditors do participate, has its shortcomings and funding remains difficult for countries participating in this initiative.

This has made negotiations longer and more difficult. As the IMF has put it recently: “Today's more complex creditor landscape makes coordination a challenge.” A case-by-case approach is now common practice, since the external debt composition differs across countries, and borrowing countries make different choices about which creditors they ask for a solution to their debt problems. The current restructuring issues in several countries however show that this approach is far from ideal.

Various initiatives have been set in motion to improve the situation. One of these is the Global Sovereign Debt Roundtable (GSDR), meant to find common ground between multilateral lenders, Paris Club and non-Paris Club bilateral creditors, private sector lenders and borrowing countries, and co-chaired by the IMF, World Bank and G20 presidency. The GSDR wants to tackle the problem fundamentally by trying to build greater common understanding among key stakeholders involved in debt restructurings, for example on information sharing and the role of the multilateral development banks in restructuring processes. The initiative goes to the heart of the problem, but given the major differences that currently exist, there is still a long way to go before there is a well-functioning coordination mechanism for debt restructuring. The IMF has also launched reform proposals which mainly focus on accelerating and relaxing its own procedures. The reforms would allow the IMF to provide financing if negotiations with creditors have not yet been completed. Borrowing countries will benefit from this, but whether this will lead to a faster conclusion of the negotiations remains uncertain. Despite these initiatives, a structural solution to the problems surrounding debt restructuring is not yet in sight.

Afke Zeilstra, Senior Economist

afke.zeilstra@atradius.com

+31 20 553 2873

Bert Burger, Principal Economist

bert.burger@atradius.com

+31 20 553 2872