Greece's recovery from the pandemic has been more dynamic as the country makes progress with ambitious reforms

-

The incumbent New Democracy government has won the election in June and pushes on with its reform agenda

-

Following a deeper recession than the eurozone during the pandemic a more dynamic recovery has set in

-

The government debt ratio is still high but declining. As fiscal prudence reigns a return to investment grade rating is on the cards

-

The banking sector has improved though vulnerabilities, especially high NPLs, remain

New Democracy wins again

The prime minister, Kyriakos Mitsotakis, and his centre right party, New Democracy (ND) won the general election in May this year. After failing to elect a government, Greece went to the polls again in June. This election allowed the winner to 50 bonus seats in the 300-seat parliament. ND won 40.6% of the vote, giving it 158 seats. The main opposition party, radical left Syriza, polled at 17.8% of the vote.

Following the developments Mitsotakis then proceeded in finally forming a cabinet. The government is expected to continue with its pro-business agenda and reforms to modernise the economy. Whilst the government can be expected to realise a considerable part of this, the challenges are considerable against a backdrop of high interest rates and cost-of-living.

Greece under Mitsotakis has strengthened its Euro-Atlantic ties significantly. With the US, a strategic partnership has been developed covering energy and security. Greece has supported the EU response to Russia’s invasion in Ukraine. The relationship with Turkey, NATO member like Greece, improved after the earthquake in that country and elections in both countries. Mitsotakis and Erdogan, the Turkish president have agreed on a series of meetings to address long-standing territorial disputes.

Better than eurozone growth

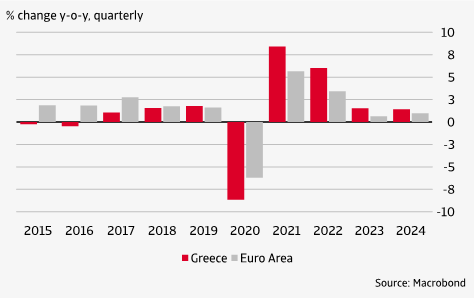

After contracting 9% in 2020, Greece GDP grew by 4.8% in 2021 and 5.9% in 2022. The recession was deeper than the eurozone on average (-6.6%) but is was followed by a more dynamic recovery. This is largely explained by the reopening of the economy after the lockdowns and the strong response of the tourism sector. GDP losses were recovered in early 2022. The energy crisis started to weigh on consumer growth in H2 2022 though, with inflation peaking in September 2022 as it averaged 9.3% that year.

Economic growth is now set to continue, though at a considerably slower pace. Economic sentiment indicators rose again in July, increasingly diverging from the eurozone where they have been falling recently. Services, especially tourism, are an important driver; industrial production is weak. Consumer confidence is rising rapidly, with no material impact from the recent fires on e.g., tourism. Q2 expansion was moderate. We expect GDP growth at 1.5% this year and 1.4% in 2024, both above eurozone average (figure 1).

Figure 1 Higher GDP growth than eurozone

Greek growth drivers

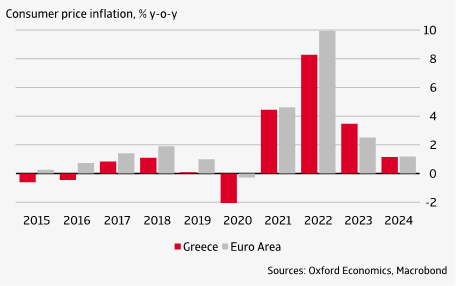

Several factors underlie this forecast. First, in July inflation bounced to 3.4%. There is no concern for this slight increase as it followed the notable drop in June. Energy is now deeply deflationary while food inflation is high at 12.3%. Core inflation is on a slow descent. As favourable base effects wane, the remaining trajectory of inflation is expected to be more gradual: 3.5% in 2023 and 2.2% in 2024 (figure 2). Energy support by the government (at a costs of 4.1% and 0.9% of GDP in 2022 and 2023) softens the impact of inflation.

Figure 2 Greek inflation declines

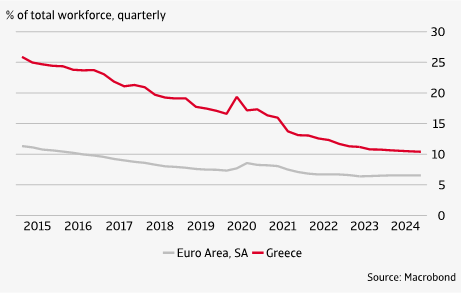

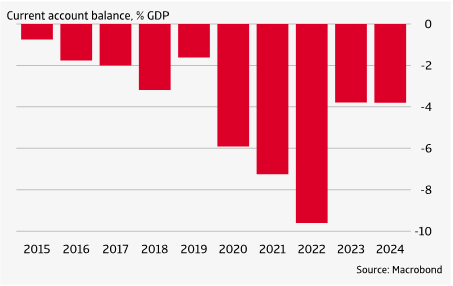

Second, the labour market dynamics are robust. June data show unemployment further decline to 11.1%, with employment up 1.1% y-o-y. This development is expected to continue, with figures remaining (far) above eurozone average in 2023 (figure 3). Real wages have taken a hit though, declining 4.7% in 2022 due to nominal wages insufficiently compensating inflation. Third, as the current account balance has deteriorated sharply over the past couple of years, recovery is now on its way back. This is due to now lower energy cost and the recovery of tourism. In Q1 the deficit dropped to 3.5% of GDP, at which level it is expected to stabilise (figure 4). Fourth, with the ECB having hiked interest rates considerably, a process that is now expected to wane, borrowing costs have gone up notably. This puts significant pressure on bank lending (see below).

Figure 3 Much improved unemployment still too high

Figure 4 Current account improving after crisis hit

Public finances in need of consolidation

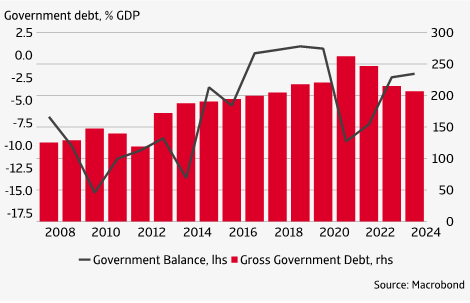

After, like almost any other country, taking a severe hit during the pandemic (government deficits of 9.7% and 7.2% of GDP in 2020 and 2021 respectively) public finances are improving. This is much needed given the rise of the debt-to-GDP ratio of 206.3% and 194.6% in 2022 and 2021.

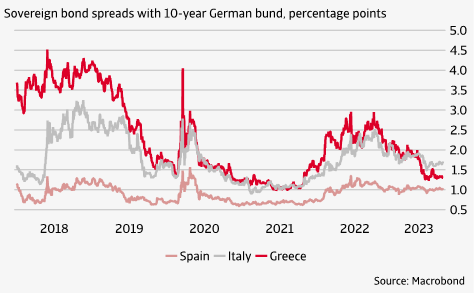

Nominal GDP growth due to high inflation and lower-than-budgeted spending means that the deficit improved in 2022 (-2.3%), which is even better than projected. The cost of energy support measures remained with EUR 3.8 billion below the original estimate (EUR 4.8 billion), helped by lower energy costs. This spending below budget signals continued fiscal prudence, just like the financing of these measures from taxes energy profits does. The debt-to-GDP ratio also declined further, to 171.3%. Financing costs have stabilised after rising steeply in line with global trends. Spreads between Greek and German government bonds have narrowed to 1.3% in August, even below the Italian one (figure 5).

Figure 5 Public finances not there yet

We do not expect this fiscal prudence as well as collaboration with the EU to change under the ND government. Government balances are expected to shrink gradually to -2.3% and -1.5% in 2023 and 2024 respectively, debt to GDP to 165.5% and 160.6% respectively (figure 6). Financing needs are expected to remain manageable in the coming years. This is due to favourable maturities and the large share of Greek debt in the hands of official creditors. The government also has ample liquidity, with 15% of GDP held as cash support. Debt sustainability risk for the short term remains low according to the European Commission’s analysis. The four major rating agencies Standard & Poor’s, Moody’s, Fitch and DBRS keep Greek government debt below investment grade, but we expect this to change over the forecast horizon.

Figure 6 Greek spread below Italy’s

Banking sector vulnerabilities lower but not gone

The picture of the banking sector remains somewhat mixed. Profitability has increased on the back of lower provisions for potential losses, new more profitable lending and one-off trading gains. This has helped restoring banks’ capital positions, especially those of the four systemic banks. Still, the quality of capital of the overall banking sector remains relatively weak.

According to the Bank of Greece, the non-performing loans (NPLs) have continued to fall, reaching 8.7% of the total loans in May 2023, as compared to 8.8% in 2022 (December), 12.8% in 2021 and 30.1% in 2020 State-supported securitisations under the Hercules Scheme were a key driver behind the sharp reduction, just like the economic recovery. Despite the considerable if not spectacular fall, the figure remains highest in the EU – by far. As the Hercules Scheme expired in October 2022 and the economy is slowing down the pace of NPL reduction is slowing and becoming more challenging. This is mitigated by the four systemic banks being expected to reach 5% NPLs in the near future.

Greek credit growth started to moderate in the second half of 2022 and has slid towards zero in July 2023. Demand from nonfinancial corporates is no longer sufficient to compensate falling household demand. Both sectors suffer from the increasing interest rates.

Pushing Greece ahead

The ND government has an ambitious program to push Greece ahead, pushing potential GDP towards 2% for the period up to 2030 (2019-2020: -1.9%). Close collaboration with the EU is in place. The Resilience and Recovery Plan (RRP) is particularly instrumental, addressing challenges to the green and digital transition, skills and social cohesion, private investment and institutional transformation. There are 68 reforms and 106 investments, supported by EUR 17.4 billion in grants and EUR 12.7 billion loans (14.5% of GDP in 2022).

The implementation of Greece’s RRP is well underway. Greece has already received a total of EUR 7.1 billion for two approved payment requests. Whilst promising, notable challenges remain, especially related to the large administrative burden imposed on regional and local authorities. These are not known for their strong administrative capacity.

Nevertheless progress has been made. Greece has already reformed labour legislation, upgraded its lifelong learning system and modernised public employment services. Key reforms have also been put in place to promote private investment, which has improved but still remains (much) below EU average. Foreign direct investment is an important element. This is aimed at bolstering the competitiveness of the economy. Especially the small size of Greek enterprises is being addressed.

John Lorié, chief economist

john.lorie@atradius.com

+31 20 553 3079