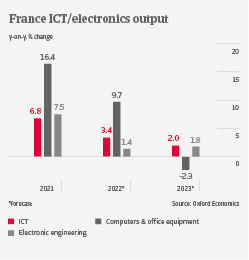

The French ICT market recorded robust growth in 2021, driven by the surge in remote working and digitalisation needs. However, demand is slowing down after peaking during the pandemic. The market for computers and smartphones is more mature, and we expect a 4% decrease in value this year. Ongoing supply chain issues (transportation bottlenecks, semiconductor shortages) have a strong impact on French ICT businesses, leading to sharp input price increases and less product offerings. Recent lockdowns in China have exacerbated this effect.

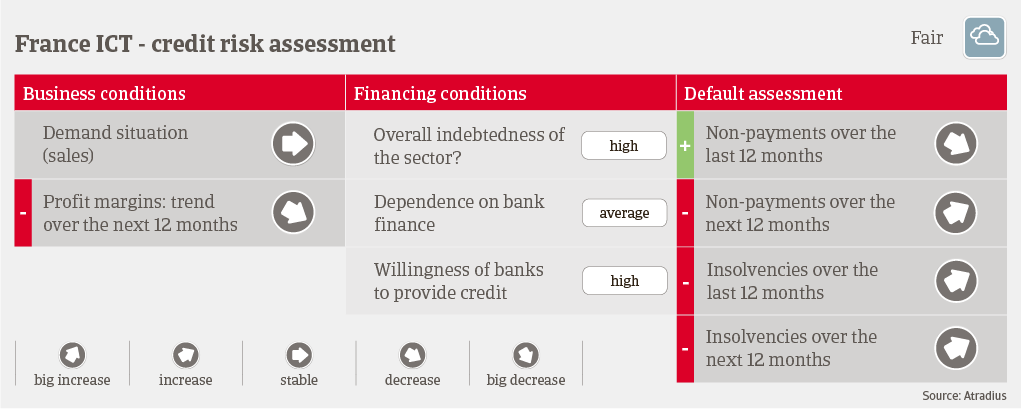

Larger producers at the upper end of the value chain (particularly in the electronic component segment) can pass on higher prices, but this is more difficult for businesses at the lower end. At the same time, manufacturers of computer equipment have difficulties in producing high value-added products due to chip shortages and destock mid-range and low-end products. This negatively affects the product offering of distributors, and hence their margins. Therefore, we expect profit margins of larger producers to remain stable while those of ICT wholesalers and retailers are shrinking, particularly smaller businesses.

According to the French Ministry of the Economy, payments in the ICT sector take 68 days on average, compared to 49 days for all industries. Public institutions and large telecommunication businesses, for example, demand extended payment terms for administrative reasons. In 2021, ICT insolvencies started to increase modestly from the historically low level seen in 2020. In Q1 of 2022 business failures were back to “normal” levels recorded in Q1 of 2019, and we expect further increases in the coming twelve months. Mainly affected will be ICT service providers and ICT wholesale/retail. Smaller businesses in those segments face higher gearing because fiscal measures have expired, while working capital requirements have increased with the ongoing supply chain issues. At the same time margins are shrinking as demand slows down, semiconductor shortages hamper product offering, and higher inputs cost are difficult to pass on to end-customers.

Our underwriting stance is neutral to cautious for ICT wholesale/retail and computer producers/services, while we are open for the electronic components and telecommunications subsectors.