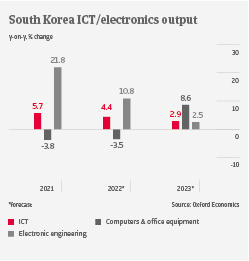

South Korea accounts for more than 9% of global electronics and computers production, and with a 29% share in manufacturing it means the country´s economy depends hugely on the industry. Lockdown-related semiconductor shortages caused some ICT production delays in 2021. Supply chain issues have gradually eased since early 2022, but we expect some chip shortage issues will persist into 2023. In the mid-term, the war in the Ukraine could severely affect the availability of raw materials like neon gas, necessary for semiconductor production. However, large South Korean chip manufacturers have great buying power in the market and good access to inventories. Additionally, South Korea has announced plans to refine neon gas domestically.

Consumers´ demand for computers and related equipment should slow down somewhat in the coming twelve months, due to a certain market saturation. However, demand from businesses will remain robust, and 5G networks, data server, cloud computing and launching of new foldable phones will sustain production and sales growth.

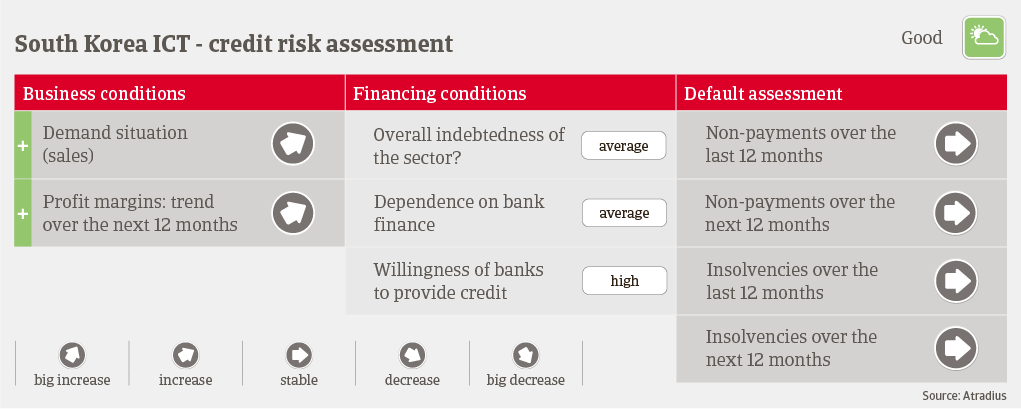

With the improvement of the chip shortage situation, robust demand for ICT business solutions and higher sales prices for consumer electronic premium devices, we expect profit margins of South Korean ICT producers will increase again next year. ICT wholesalers and retailers will have to deal with higher input costs passed on to them by manufacturers but should be able to compensate with robust ongoing sales.

Payments in the ICT industry take 60-90 days on average, and payment behavior has been good during the past two years. The number of payment delays and insolvencies has been low in 2021 and H1 of 2022. Given ongoing solid demand, the low gearing of businesses across all subsectors, and open loan policies by banks, we expect the credit risk situation for ICT will remain good. Therefore, our underwriting stance is open across all ICT subsectors. We expect a 7.7% compound annual growth rate of South Korean electronics/ICT sector output in the 2019-2025 period.