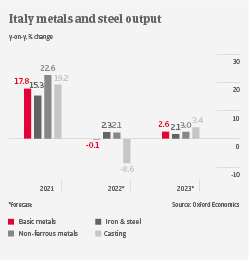

In 2021 and Q1 of 2022, metals and steel output and sales grew strongly. However, this started to reverse in Q2 in 2022. The outbreak of the war in Ukraine caused some panic buying in March and April, followed by a slowdown in May and June amid de-stocking activities. We expect that demand from automotive will remain lower in the coming months but remain higher from engineering and construction.

Due to the high level of demand in 2021 and Q1 of 2022, the majority of metals and steel producers could easily pass on higher input prices for raw materials and energy to their customers, and significantly increase their profit margins. The same goes for distributors, although at a lower level. Many metals and steel businesses recorded positive cash flows in 2021 and early 2002, leading to lower debt levels. However, ongoing de-stocking activities and the slowdown in demand have clouded prospects. Businesses´ margins should remain stable at best in the coming months.

Payments in the industry take 110 days on average, and payment behavior has been good during the past two years. However, there will be less liquidity available, due to the combination of lower demand and high energy prices. Businesses, which have generated large profits and cash in 2021, should be more resilient. Currently, we expect just a slight increase in payment delays and business failures in the coming twelve months. However, an extended war in the Ukraine and a recession in the Eurozone, leading to a combination of curtailed gas supply and sharply deteriorating demand, could trigger a contraction of metals and steel output of about 1.5% in 2022 and 5% in 2023. This would result in more business failures than currently expected.

Given the robust performance and profit growth in 2021, we still assess the credit risk situation of the industry as rather good. This mainly accounts for the iron and steel segment, which generated satisfactory cash flows. We assess the credit risk of the non-ferrous segment as neutral. The performance of aluminium and copper producers in 2021 was good in terms of margins, but often resulted in negative cash flows due to higher working capital requirements. We are more restrictive with businesses active in the casting segment, which is highly dependent on automotive, and will be negatively affected by the ongoing transition towards e-mobility.